Table of Contents

This article does not constitute investment advice; consult a financial advisor before investing.

According to The Information and the Wall Street Journal, SpaceX, of Falcon 9 and Starship-Super Heavy reusable rocket and Starlink internet mega-constellation fame, is eyeing a valuation of 800 billion United States Dollars ahead of a potential initial public offering (IPO) in 2026, with the outlets citing the company’s Chief Financial Officer Bret Johnsen.

SpaceX head Elon Musk has been debating an IPO for the space company for several years, as it is his only business to deliver an advertised product. Up until the reports were released, the understood philosophy for a SpaceX-related IPO would have seen the Starlink internet mega-constellation spun off as it was viewed as more palatable to investors due to its regular income from corporate, government, and consumer subscriptions. Something since then has changed, possibly including Musk's personal feud with OpenAI's Sam Altman. An 800 billion dollar pre-IPO valuation would see SpaceX being the most valuable private company and move ahead of OpenAI in that regard.

A potential IPO timeline is intentionally vague from SpaceX officials, like other previous talks of one. Quartz has suggested, citing Bloomberg, that pre-IPO share sales may value the company closer to 560 billion dollars, while noting that that valuation will be dependent on the number of investors and their willingness to spend. At the moment, the only way to buy into SpaceX shares is through 'trusted' firms on a secondaries market.

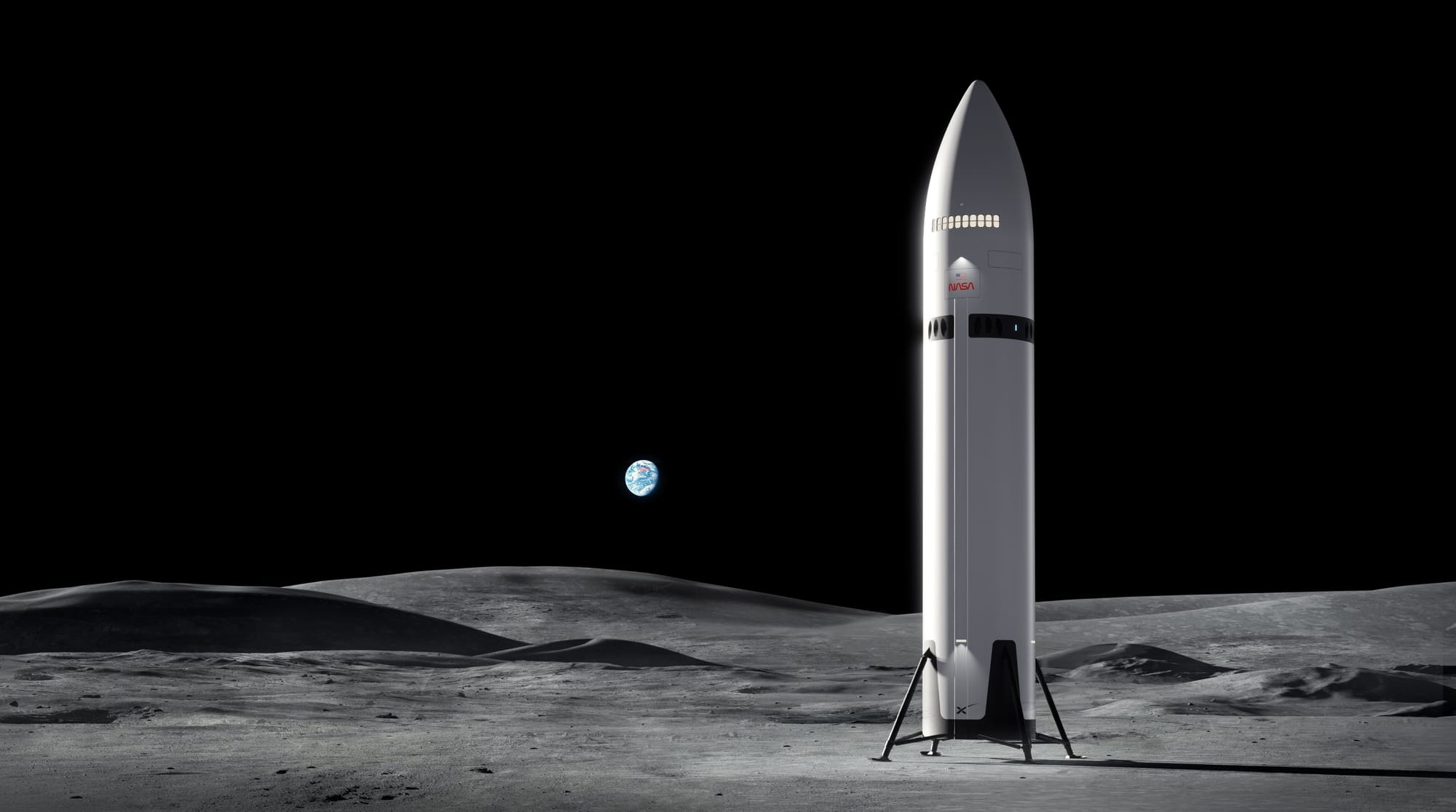

The critical consideration for any investors in SpaceX post-IPO will be cash flow. As a private company, SpaceX does not disclose its earnings or its spending, excluding random tangents from Musk. Estimates suggest that the company brings in a revenue of around 13 billion Dollars as of 2024, with several of those billions coming from numerous government contracts. While revenue is being generated, significant sums of money are being spent on developing the Starship-Super Heavy launch vehicle, projected to be in the double-digit billions by the time its systems are proven for operation.

Limited success of space IPOs

If SpaceX does decide to go through with an IPO, it would not be joining a long list of successful companies. In early 2021, Astra IPO'd but was later delisted in early 2024 due to the company's failure on seven out of its nine launches with its small-lift orbital rocket. Virgin Orbit, with its Boeing 747-launched small-lift rocket, followed in December 2021. By mid-2023, the company had filed for bankruptcy, auctioning off its assets, following a launch failure and failure to secure additional financing.

This year, Firefly Aerospace completed its IPO after a successful lunar landing, which was shortly followed by a failed orbital launch. Now publicly traded, the company has gone about its business as planned, but has suffered a hardware failure during testing, dropping its stock price. As a result, its valuation and stock price have slumped to a third of IPO levels.

To date, the only publicly traded company performing orbital launches to survive and thrive after an initial public offering is Rocket Lab, with its small-lift carbon fiber Electron launch vehicle. The company has managed to thrive thanks to a series of strategic acquisitions to position itself within the satellite manufacturing business, producing necessary components, instruments, or entire spacecraft. This has enabled the company to work with customers from satellite design to orbital deployment. However, following launch failures and complex hardware announcements, the stock does experience drops.

That history bodes both well and unwell for SpaceX. Starlink is a reliable income source with Falcon 9 now failing rarely. However, Starship-Super Heavy is a different beast. During 2025, the development program had regressed significantly in terms of progress. In June, Ship 36 unexpectedly exploded during a routine test, wiping out a critical pre-flight test stand with it. Meanwhile, during flight tests of the vehicle, Ship 33 was lost due to a fire in its engine section in January. Next in March, Ship 34 was again lost in a fire. Then in May, Ship 35 was destroyed during atmospheric reentry following leakages across the vehicle. 2025's progress peaked at previously achieved milestones on par with an older design, while delaying expected NASA milestones. That many high-profile failures and a lack of progress are not confidence-inspiring for average investors.

Mars dreams die?

As has been mentioned above, everyday investors are not very favorable to spaceflights risks and random hardware explosions, and SpaceX has more explosions than any other company due to their so-called 'iterative process' of development with Starship. That processes will have seemingly trivial tests fail while replacing a proven design with something new in the pursuit of every tiny bit of performance.

The 'Raptor 3' engine is one of those designs; as 'Raptor 2' brought Starship-Super Heavy through its first eleven flight tests. Despite that SpaceX is now reworking the engine to integrate all parts of it into one unit that can survive intense booster recovery heat with no extra protective material. A risky but innovative development effort like 'Raptor 3' would not happen with a publicly traded company, as shareholders would want a system built on what works for earlier returns on development investments (i.e. a Starship-Super Heavy carrying customer payloads but still in its 'Block 2' form with 'Raptor 2').

Validation testing on a Raptor 3 performing a Starship V3 ascent burn. Multiple versions of this test will cover the different conditions seen by Starship’s three inner engines during its initial climb to space pic.twitter.com/Rrd4rEuGqt

— SpaceX (@SpaceX) December 3, 2025

A sea-level Raptor 3 engine test to demonstrate an ascent burn, via SpaceX on Twitter.

Another SpaceX plan that investors are unlikely to support are plans for Mars colonization. Under the company's current plans, thousands of spacecraft will be shot toward the red planet with cargo and people, with few ever to be seen again on Earth, for a gigantic financial sink in an effort to 'backup' human existence. Other than scientific payloads for governments and the rare super-rich space tourist, there is no way to monetise Mars colonization with the exception of speculative financialised assets from indentured servitude (slavery), something with Musk has said will be an option despite its near-global illegality. Naturally, investors may not like placing money into a company that could have all its Earth-located assets seized.